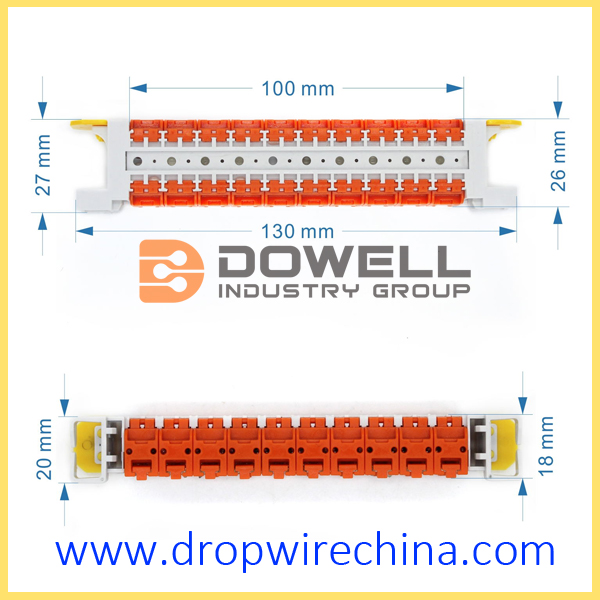

quick connection system including 2810 tool-less

module and QCS block and terminal box. Module and box body material is PC and

for back mounting frame is stainless steel. 2810 module have two types, one is

single pair unit cap and another caps is 5 pair one unit. Contact IDC material

is phosphor bronze with Tin plating. 2810 block can be exceed cat 5 standard

transmission.

QCS blocks have 30-pairs, 50-pairs,

100-pairs three types to your choice. Tool-less wire design not need any other

punch tools. Can be fast and easily finish the cable termination. Module both

sides have two cable guide to management.

quick connection system,2810 toolless module,2810 terminal block DOWELL INDUSTRY GROUP LIMITED , http://www.dropwirechina.com

However, this does not mean that domestic TVs can sit back and relax. According to a related person in Guangzhou Gome, in the first half of this year, the top three brands of Guangzhou Gome TV brand sales were foreign TVs, and foreign brand sales accounted for more than 60% of the total color TV sales. The data provided by a home appliance chain in a certain city also shows that in the first half of this year sales, foreign brands accounted for about 65% of sales, domestic brands only 35%.

The twists and turns before the domestic color TV won over half of the country

Since 2003, flat-panel TVs have entered China for nearly 10 years. According to data from Yikang, domestic color TVs have captured the majority of the domestic market. From January to April this year, the local brands Hisense, Skyworth, TCL, Konka, Changhong and other market share reached 64.54%, Samsung, Sony, Sharp, Panasonic and other foreign brands accounted for less than 35%.

Taking Hisense as an example, since 2004, Hisense has topped the domestic flat panel market for the sixth consecutive year in the flat-panel market. In 2009, Hisense’s market share was once as high as 16.5%. From January to April this year, Hisense’s market share was 14.78%; Skyworth followed closely, accounting for 12.86%; and TCL ranked second, with market share accounting for 10.8%.

"The performance of domestic color TV in the flat-panel TV market can be described by a roller coaster," said someone in the industry.

Analyze the 8 year data of Yikang, the market share of Chinese and foreign brands has changed several times. China-made color TVs have suffered from a downturn in the market share of less than 35% in 2004, and have also experienced 70% of the glory in 2009.

Before 2004, the domestic flat-panel TV market was very small, and foreign brands with core technologies accounted for nearly 80% of the market share. However, since the rapid rise of domestic brands after 2004, the market share has gradually caught up with foreign capital, becoming the main force of the domestic flat-panel color TV market, and the overall market share for the next five years has hovered between 50% and 60%.

After experiencing the "price war" and "panel shortage", in 2009, the Chinese flat-panel TV market reversed market growth at the time when the global color TV industry had not yet fully recovered, and achieved profitability for the entire industry. In 2009, the sales volume of Chinese and foreign color TV brands accounted for 7:3. This optimism continued until 2010, when domestic color TV makers purchased a large number of panels and production units in advance, causing huge inventory pressure. Samsung and other foreign brands drastically reduced prices, and China's color TV industry once again suffered collective losses in 2010. The proportion fell to 59.6%.

From January to April of this year, the market share of Hisense, Skyworth, and Changhong began to increase again, while the market share of foreign brands declined.

Appliances go to the countryside to help the rise of domestic color TV

The "victory" of domestic brands has benefited from the preferential policies for home appliances to the countryside and trade-in, and it has found new breakthroughs -- the third and fourth-tier cities have become new positions. However, due to the lack of channels in third and fourth-tier cities, foreign capital is not sufficiently deep in the Chinese market to compete with domestic brands in this area.

In the second half of 2009, flat-panel TVs began to be incorporated into the home appliance sector, accelerating the popularity of flat-panel TVs in China's third and fourth-tier markets. From the fourth quarter of 2010, shipments of flat-panel TVs in the rural market began to exceed the urban market, and this trend was even more pronounced in the first quarter of this year.

Ovi's data shows that the rural market now accounts for nearly 50% of the total, becoming the latest largest growth point in the flat-panel market. In the first quarter of this year, rural flat panel sales reached 4.74 million units, accounting for 48% of the country's total, which is nearly half. Among the products for home appliances to the countryside, the proportion of flat-panel TVs is getting higher and higher, currently exceeding 80%.

“Now we have devoted a lot of energy to exploring the rural market and doing a variety of exhibition activities in rural areas.†Hisense responsible for market sales told this reporter that during the countryside tour, Hisense was the highest in a township in Weifang, Shandong Province. The sales record reached 30 million yuan, equivalent to the sales volume of the entire Shandong Province that day.

The reporter learned that in the TV sales of home appliances to the countryside, the domestically produced six brands accounted for 90% of the market share, while big-name foreign brands such as Samsung and Sharp were basically excluded.

Some foreign investment in color TV has fallen

According to data from Yikang, the market share of foreign color TVs in China has dropped as a whole, and Philips, Toshiba, and Sanyo are no longer brilliance. The Toshiba TVs that once stood out in the TV industry have appeared to be “unfavorable in recent yearsâ€. The market share of color TVs in China has even dropped by 10, from 5.30% in 2004 to 1.63% today; Philips is from 7.09% fell to 1.21%, and its decline was obvious; while Sanyo has occupied less than 2% of the market share for many years.

What's more, Hitachi, which has been losing money in the color TV business, recently made clear that it will sell LED backlight technology and gain billions of yen in sales through the sale of technology. It hopes that its color TV business will turn around in the second half.

In fact, in the past two years, some foreign color TV brands are facing market challenges and have had to explore more possibilities to rebuild their glory.

These include cooperation with Chinese companies, cooperation with Gome supermarkets, and OEM OEMs that have become a trend. In April this year, Sanyo TV and Gome announced a five-year deep cooperation agreement. As for Toshiba, it is an option to form an alliance with TCL. TCL's production base is commissioning processing of Toshiba color TVs using ODM.

Sharp, Samsung, and Sony's top-tier cities Although some foreign brands have shown a declining trend, Sharp, Samsung, and Sony still occupy a relatively large market share. Among them, Sharp also achieved a slight improvement from last year to the first quarter of this year: From January to April this year, Sharp's overall market share reached 8.39%; Samsung was 6.89% and Sony was 6.8%.

Luo Qingqi, a senior director of Pall Consulting, pointed out that due to the relatively high economic strength and brand loyalty, consumers in the primary and secondary markets favor foreign brands, and foreign brands account for approximately 40% of sales in sales. It is completed in the primary and secondary markets.

Guangzhou Gome disclosed to the newspaper in the first half of 2011 TV brand sales rankings show that Samsung, Sharp, Sony ranked the top three, the fourth named LG, domestic brands ranked the highest is the fifth Skyworth; while foreign brands in TV sales Accounted for more than 60% --- In the first half of last year, the top four sales of Guangzhou Gome TV were also foreign brands, namely Samsung, Sharp, LG and Sony.

The data provided by another city's home appliance chain also showed similar results: In the first half of this year, the joint venture brands accounted for about 65% of the color TV sales in the city, and domestic brands accounted for about 35%. The top four sales are all foreign brands: Sharp, Samsung, Sony, and LG; then there are domestic brands such as Hisense, Skyworth, and TCL.

Undoubtedly, the secondary market or above is a market with a relatively high economic level and is the first market for new products to enter. Foreign TVs rely on their own advantages in the upper reaches of the industrial chain and the mastery of the core technologies. They hold the power of TV sales in the first and second tier cities in China. In the large and medium-sized cities market, large-size flat-panel TVs continue to maintain momentum, and foreign-owned brands with 46-inch and above products are also favored by more consumers.

“In the future, the market concentration of color TVs will continue to increase.†According to analysis by industry experts, according to the growth trend of the color TV industry, it is expected that within five years, there will be similar oligopolies in the “ice, air, and wash†market, ie, the top three positions. The cumulative total of the brand market will exceed 50%. “Companies with strong technology accumulation and profit advantages will come to the fore and confuse the 'profits' crux of the TV industry to be truly improved.†

Home appliances to the countryside to help the rise of domestic color TV

Recently, China Yikang disclosed for the first time the "2004-2011 China Flat-panel TV Market Overview" data. Data show that since the beginning of 2004, domestic color TV sets and foreign-funded color TVs have been in the midst of fierce competition: In January-April this year, the share of domestic color TV sets reached nearly 65%, and only domestic brands such as Hisense, Skyworth, and TC L Occupy about 40% of the domestic market. At the same time, since 2004, the market share of foreign color TVs has shrunk overall, and its market share dropped to 35% from January to April this year.